Introduction

The investments of the FHUT are governed by the Scheme Deed. The specific framework for the investment strategies used by the Manager is contained in the investment Policy Statement that is approved by the Trustee.

Investment Objectives

The investment objective of FHUT is to provide the Unitholder, with income (dividends) every four months and potential capital gains on your investment which will occur if you invest over the medium to long term i.e., 3 – 5 years and more through possible increase in unit price over that period.

This type of investment is suitable if you want the value of your funds to grow over the long term and understand that the returns may fluctuate over the short to medium term.

Authorized Investments

The authorized investments for FHUT are fixed income securities such as government and statutory body bonds, shares of listed and unlisted companies, properties and short-term money market securities such as promissory notes. This includes overseas investments as well, which the Manager may pursue with the approval of the Trustees and RBF.

As per FHUT’s Investment Policy Statement, a maximum of 10% of the portfolio value may be invested offshore. The FHUT’s exposure in any one single investment should not exceed 40% of the investment companies’ shareholding. The RBF approval needs to be obtained for any restricted investments exceeding 35% of the portfolio and associated company’s investments.

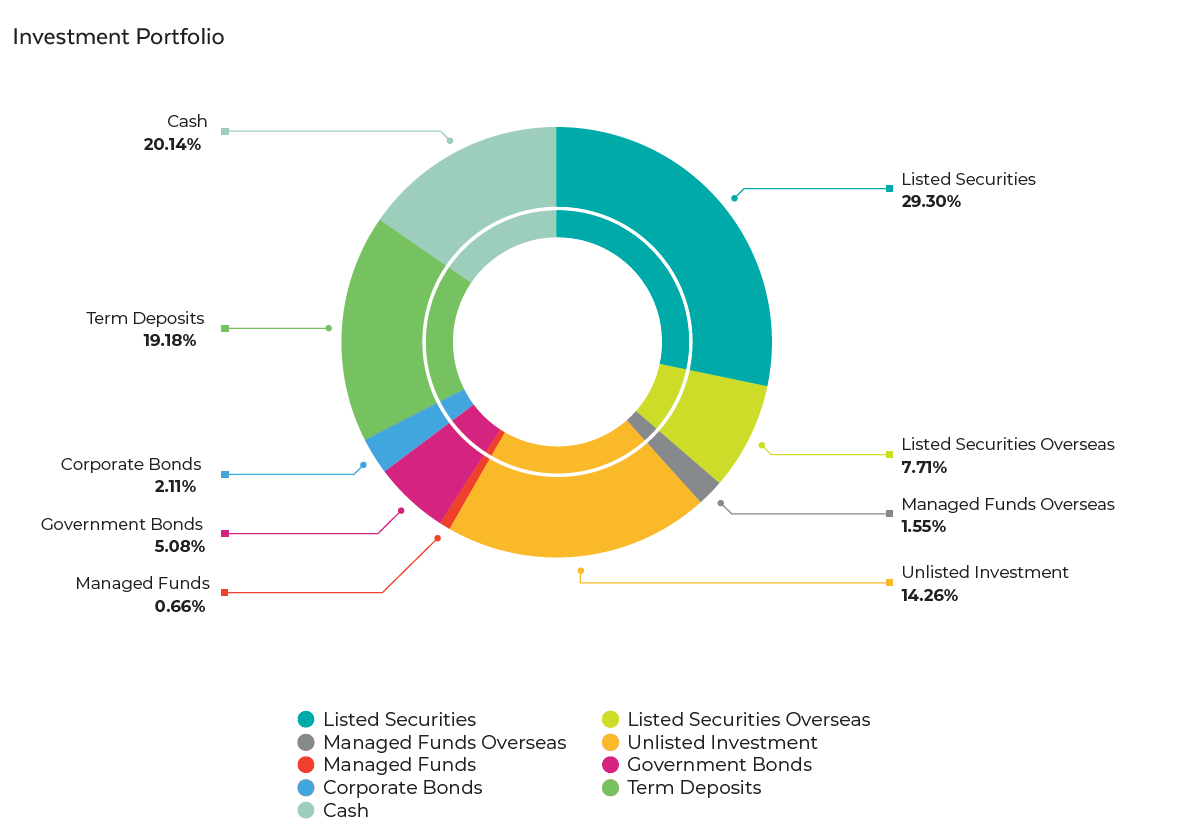

Investment Portfolio

The total market value for FHUT portfolio as at 30th June 2025 was $237.31 million, as represented in the pie chart: