Frequently Asked Questions and Answers

A unit trust (or managed fund) is an investment vehicle that pools the money of many individual investors into a Fund. This fund is then invested by a professional manager in line with the investment objectives of the Fund. As an investor, you can expect to receive returns in proportion to the number of units that you hold at the time of the dividend declaration.

A unit is issued to an investor when he/she invests his/her funds into a unit trust (or managed fund). These units represent an investor’s share of the total net assets in the Fund.

Fijian Holdings Unit Trust is a diversified income and growth managed investment scheme, regulated by the RBF. FHUT funds are pooled and invested by the Fund Manager, FHL FML, to enable Unit holders’ investments to grow in value and earn income over time.

Listed below are terms used in the asset allocation together with simple definitions:

- Listed equities – are shares in companies listed on the South Pacific Stock Exchange.

- Unlisted equities – are shares in privately owned companies.

- Quoted Managed Funds – are investments in other managed funds available in Fiji.

- Bonds – are long term debt securities owed by Government or statutory bodies.

- Term Deposits and Short term investments – comprise of on-call deposits and short term loans with various deposit taking institutions and companies.

Anybody can invest in FHUT if the legal requirements outlined in “Requirements When Purchasing Units” are fully complied with.

The initial minimum investment is 50 units (10 units for Employee Deduction Scheme). The total cost of this investment will be calculated by multiplying the current entry price1 with the initial minimum units. e.g., 50 units x $0.98 = $49.00.

There is no defined minimum investment period however unit trusts are considered medium to long term investment products. This means that it is recommended that you leave your investment in the fund for a minimum of 5 years. Please note that you may incur capital loss on your investment if you redeem your units before the recommended period.

There is no minimum balance for units to be held with FHUT, however, to qualify for dividends in FHUT, 50 units must be maintained by Unit holders at dividend cut-off date on 31st October, 28th (29th) February and 30th June annually.

To purchase units in FHUT you must first read the FHUT Prospectus before completing the application form attached to this Prospectus on page 39. Customer information and documents will also need to be provided for verification purposes. Once the customer account is created, a receipt will be issued to you upon receipt of funds. FHUT units can be purchased from our customer service locations on page 34 – 35: Shop 1A & 1B and Level 6 Vanua House, 77 Victoria Parade, Suva; 2nd Floor, Shop 6 Challenge Plaza, Naviti Street, Lautoka; 2nd Floor, Trikams Building, Main Street, Nasekula Road, Labasa or from any of our service providers namely; Post Fiji Pte Limited offices, Merchant Finance Pte Limited branches, Fiji-Stock Brokers Pte Limited, Kontiki Stockbroking Pte Limited, FHL Stockbrokers Pte Limited, Mr. Napolioni Batimala, Ms. Priscilla Greig and Mr. Deven Magan. Top-ups can either be made directly through one of the service providers listed above or through Electronic Banking and Vodafone M-Paisa.

Some of the benefits and risks of investing in FHUT are clearly stated on pages 13 and 14 of this Prospectus (Link with PDF).

FHUT’s dividend distribution policy is to pay dividends to its Unit holders that hold 50 units or more, three times a year on 21st of every payout month, November, March and July each year.

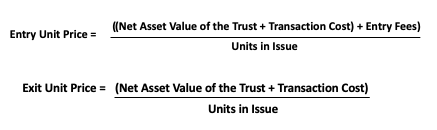

The unit price is determined using the following formulas:

For detailed examples of this calculation, please refer to page 24 and 25 of this Prospectus (To link PDF) or speak to one of our licensed representatives.

Within 15 working days from the close of the creation, you will receive confirmation of your investment with a cover letter confirming the details of your new investment account stating your FHUT account number, account name, unit certificate number and number of units purchased. You will also receive your unit certificate with FHUT identification card detailing your FHUT account name and number.

You can purchase more units at any point in time from any of our customer service office or any of our service providers listed on page 34 (Link to PDF) at the entry price prevailing at that time. There is no limit to the number of units that you can purchase.

In completing the FHUT application form, Unit holders can indicate if they want their dividends to be reinvested. This means that instead of paying the dividends to you, we will purchase more units and top up your existing account with FHUT. A statement showing proof of this purchase will be sent to you.

Once the new creation pricing has been confirmed, your withdrawal processing period will vary according to your requested amount as detailed in the table below. Manager may provide payment plan to split the application amount. An application will be processed from the day the completed application form is received at FHUT’s office as follows:

| Redemption Amount | Processing Time |

| < $1,000 | 2 – 3 working days |

| $1,001 – $10,000 | 3 – 5 working days |

| $10,001 – $100,000 | 5 – 7 working days |

| $100,001 – $500,000 | 8 – 10 working days |

| > $500,001 | 10 – 15 working days |

All fees and charges paid to the Manager are detailed on page 31 of this Prospectus.

Yes, FHUT units can only be fully transferred (not partial) by its Unit holders to any individual or entity provided all requirements set by the Manager are met. The Manager will not charge any fee on the redemption or transfer of FHUT Units by Unit holders during the life of this prospectus.

The manager will calculate the price and provide to the Unit holders and the public the price of one FHUT unit on a bimonthly basis through the media.

Any questions and complaints should be directed to the Manager or the Trustee first, however if you are not happy with the outcome, you may seek redress with the Chief Manager Financial Institution Group at the RBF. More details are on page 33 (Link to PDF).

The FTR Act and FTR Regulation imposes on FHUT certain obligations aimed at preventing and detecting money laundering and terrorist financing which is guided by the Financial Transaction Reporting (FTR) Act 2004 with the following guideline:

- Guideline 1: Suspicious Transaction Reporting

- Guideline 2: Reporting a Suspicious Transaction

- Guideline 3: Reporting Cash Transactions of $5,000 or above

- Guideline 4: Customer Identification & Verification

- Guideline 5: New Technologies

- Guideline 6: Higher Risk Countries

- Guideline 7: Politically Exposed Persons (PEPs)

Under the FTR Act, FHL FML is required to submit two types of reports to Fiji Intelligence Unit (FIU); Suspicious Transaction Reports (STR) and Cash Transaction Reports (CTR). CTR requires the Manager to report cash (notes and coins only) of $5,000 and above. STR requires the Manager to report any transaction which is inconsistent with a customer’s known legitimate business or personal activities or with the normal business for that type of account.

Some key measures required under the Regulation are:

‘Know Your Customer. i.e. identify clients, verify their identity and the source of funds (money) they are investing in FHUT, monitor clients’ transactions, maintain proper client records, report suspicious transactions to the Financial Intelligence Unit and implement appropriate internal controls and systems to protect FHUT from being used for money laundering and terrorist financing purposes.

This is subject to changes on a fortnightly basis.

Investors are advised to read and understand the full contents of the prospectus. If in doubt, please consult our Licensed Managed Investment Scheme Representatives or a Licensed Investment Adviser